Slides & Script

Build your webinar slide by slide with script narration

1

Slide 1: Welcome & Agenda

Good morning, everyone, and thank you for joining us for 'Refinance Reality Check. ' In today's volatile market, the question of whether to refinance is more complex than ever. We'll be cutting through the noise to give you a clear framework for making this critical financial decision. We'll start by looking at where rates stand, analyze the immediate benefits and risks, and then provide the tools you need to calculate whether refinancing makes sense for your specific situation. (Transition to Slide 2)

Let's set the stage. Mortgage rates are not set in a vacuum. While the Federal Reserve influences short-term lending, mortgage rates track closer to 10-year Treasury yields, which react to inflation and economic forecasts.

2

Slide 2: The Current Rate Landscape

We've certainly moved past the pandemic lows, but it's important to keep perspective: current rates, while higher than two years ago, are still competitive compared to the 1980s or 1990s. The crucial takeaway here is that you shouldn't paralyze your decision by waiting for a mythical rock-bottom rate. Focus on what rate improves your current financial position. (Transition to Slide 3)

There are compelling reasons to act immediately. The most obvious is securing a lower monthly payment, which provides instant cash flow relief. However, refinancing isn't just about the rate. Cash-out refinancing is a powerful tool for strategic debt consolidation, especially if you have high-interest credit card debt.

3

Slide 3: Why Refinance Now? (The Immediate Pros)

Furthermore, if you've been in your current loan for a while, refinancing into a shorter term, like a 15-year, can save you tens of thousands in interest over the life of the loan. And don't forget the immediate financial win of removing Private Mortgage Insurance if your home value has increased. (Transition to Slide 4)

Now, let's look at the risks of refinancing prematurely. The biggest hurdle is the closing costs. These are sunk costs that you must recoup through monthly savings. If you only save $50 a month, but closing costs were $5,000, it will take you 100 months just to break even. Also, be mindful of 'resetting the clock.

4

Slide 4: Why Wait? (The Potential Cons & Risks)

' If you are 10 years into a 30-year loan and refinance back into a new 30-year loan, you've extended your total repayment period. The primary reason to wait is the hope for lower rates, but remember, timing the market is nearly impossible. We recommend using the 'Two-Point Rule' as a conservative benchmark. (Transition to Slide 5)

This is the most critical slide. Before you sign anything, you must calculate your break-even point. This calculation tells you exactly how long it will take for the monthly savings generated by the lower rate to offset the upfront closing costs. If your total closing costs are $4,000 and you save $100 per month, your break-even point is 40 months, or 3 years and 4 months.

5

Slide 5: Key Calculation: The Break-Even Point

If you plan to move within three years, refinancing today is a net loss. This calculation should be the anchor of your decision. (Transition to Slide 6)

Your Loan-to-Value ratio is crucial. It’s the percentage of your home’s value that you are borrowing. If your LTV is above 80%, you may be required to pay Private Mortgage Insurance, which is an extra monthly cost. Conversely, if your LTV is low, say 60%, you are a very attractive borrower and will qualify for the best available rates. If you suspect your home value has increased significantly, refinancing may be worth it just to drop the LTV and eliminate PMI, even if the rate reduction is modest.

6

Slide 6: Understanding Loan-to-Value (LTV)

(Transition to Slide 7)

When you refinance, you generally choose between two types. Rate-and-term is straightforward—you are optimizing the loan structure. Cash-out refinancing is a strategic financial maneuver. If you have significant equity, using a cash-out refi to pay off debt charging 20% interest with a mortgage rate of 6% is a massive arbitrage opportunity. However, treat the cash-out responsibly. It should be used to improve your net worth or reduce expensive liabilities, not fund a vacation. (Transition to Slide 8)

If you decide to wait, you need to know what you're waiting for.

7

Slide 7: Strategic Refinancing: Cash-Out vs. Rate-and-Term

Keep a close eye on inflation data. If inflation is cooling, the Fed is less likely to raise rates, which generally pushes mortgage rates down. The 10-Year Treasury Yield is the most direct indicator. If it drops, mortgage rates usually follow. While these indicators give you a sense of direction, they should inform your timing, not dictate it. Set a target rate—say, 0. 5% lower than current—and commit to acting when that target is hit, regardless of whether the market might drop further.

8

Slide 8: Market Indicators to Watch

(Transition to Slide 9)

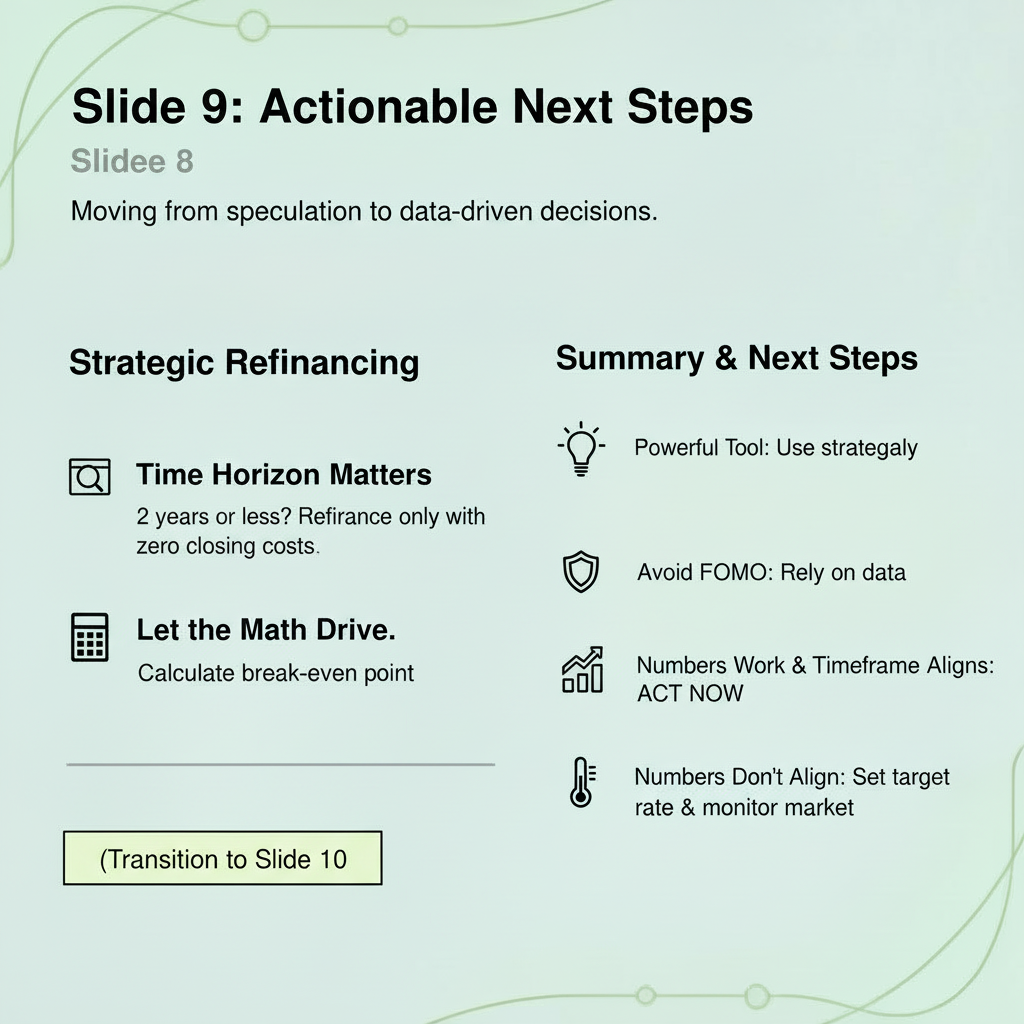

So, what should you do when you leave this webinar? First, gather your data. Second, shop around. Loan Estimates are standardized documents, making comparison easy. Don't just look at the rate; look at the total closing costs. Third, run the break-even calculation. Fourth, be honest about your future plans.

9

Slide 9: Actionable Next Steps

If you plan to move in two years, refinancing is almost certainly a bad idea unless you have zero closing costs. Use these steps to move from speculation to a data-driven decision. (Transition to Slide 10)

To summarize: Refinancing is a powerful tool, but it must be applied strategically. Don't let fear of missing out drive your decision. Let the math drive it. If the numbers work and your time horizon supports the break-even point, act now. If not, set a target rate and monitor the market.