Slides & Script

Build your webinar slide by slide with script narration

1

Revolutionizing Franchise Growth Through Capital Access

Thank you for taking the time to be here. Today, I want to introduce you to Franchise Funding Solutions—FFS—a platform built by a franchise operator, for franchise operators. This is about removing the biggest obstacle to smart growth: access to fast, affordable, institutional-quality capital. Our goal is simple—help elite franchise owners scale faster, cheaper, and with more control.

2

The Promise – Fast. Cheap. Funding

At FFS, everything we do centers on three words: capital, speed, and freedom. Capital that’s easy to access. Speed that matches real-world expansion timelines. And freedom from restrictive bank covenants and endless underwriting. This is funding designed to support growth—not slow it down.

3

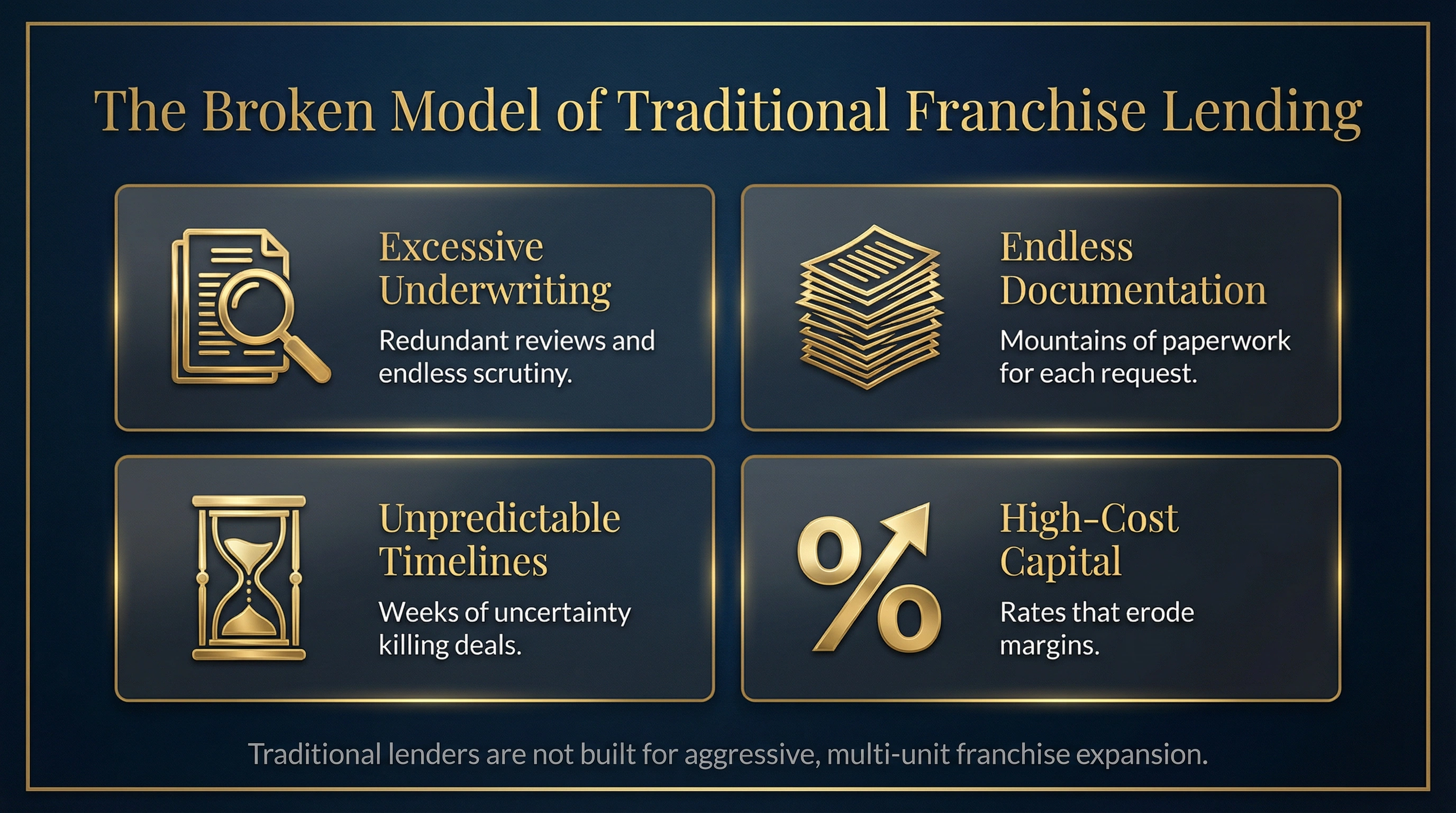

The Problem

If you’ve grown through traditional lending, this will sound familiar. Excessive underwriting. Endless documentation. Unpredictable timelines. And worst of all—high-cost capital that limits how fast you can scale. Traditional lenders are not built for aggressive, multi-unit franchise expansion.

4

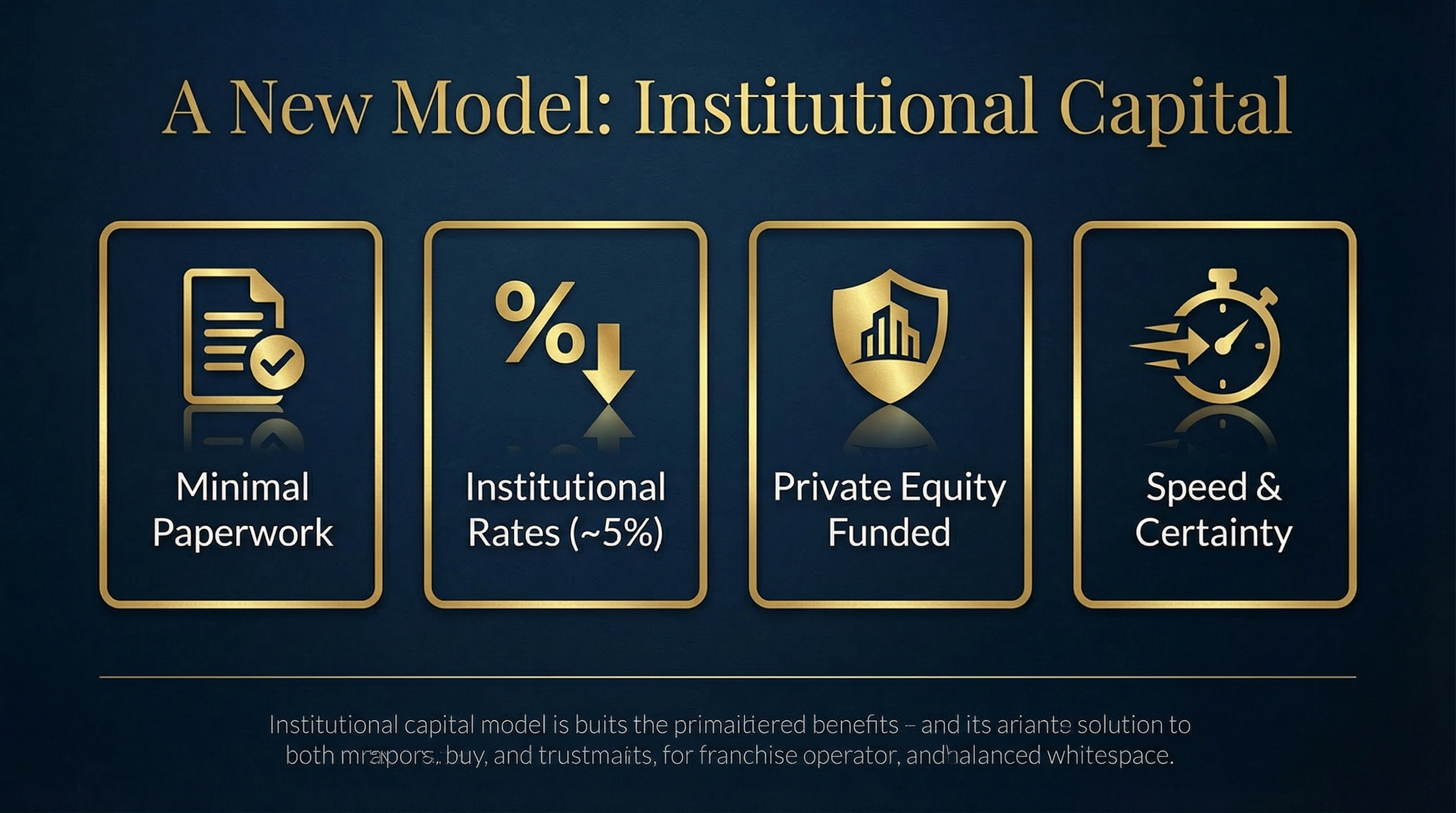

The Solution

FFS replaces that broken model with pre-structured, investment-backed financing. Minimal paperwork. Institutional-rate loans. And a lending structure funded by private equity—not retail banks. This gives franchise owners certainty, speed, and meaningful savings from day one.

5

What Is FFS?

FFS is a Special Purpose Vehicle—an SPV Lending Club—created by a franchise owner who understood the pain points firsthand. Members pool capital into a professionally managed structure that provides low-cost, secure loans exclusively to the club’s operators.

6

How It Works – Overview

To join, members make a one-time $225,000 membership contribution. That capital is pre-allocated for lending across new development, remodels, acquisitions, and expansion-related needs. Members borrow at institutional rates—historically around five percent total—and payouts begin in year two.

7

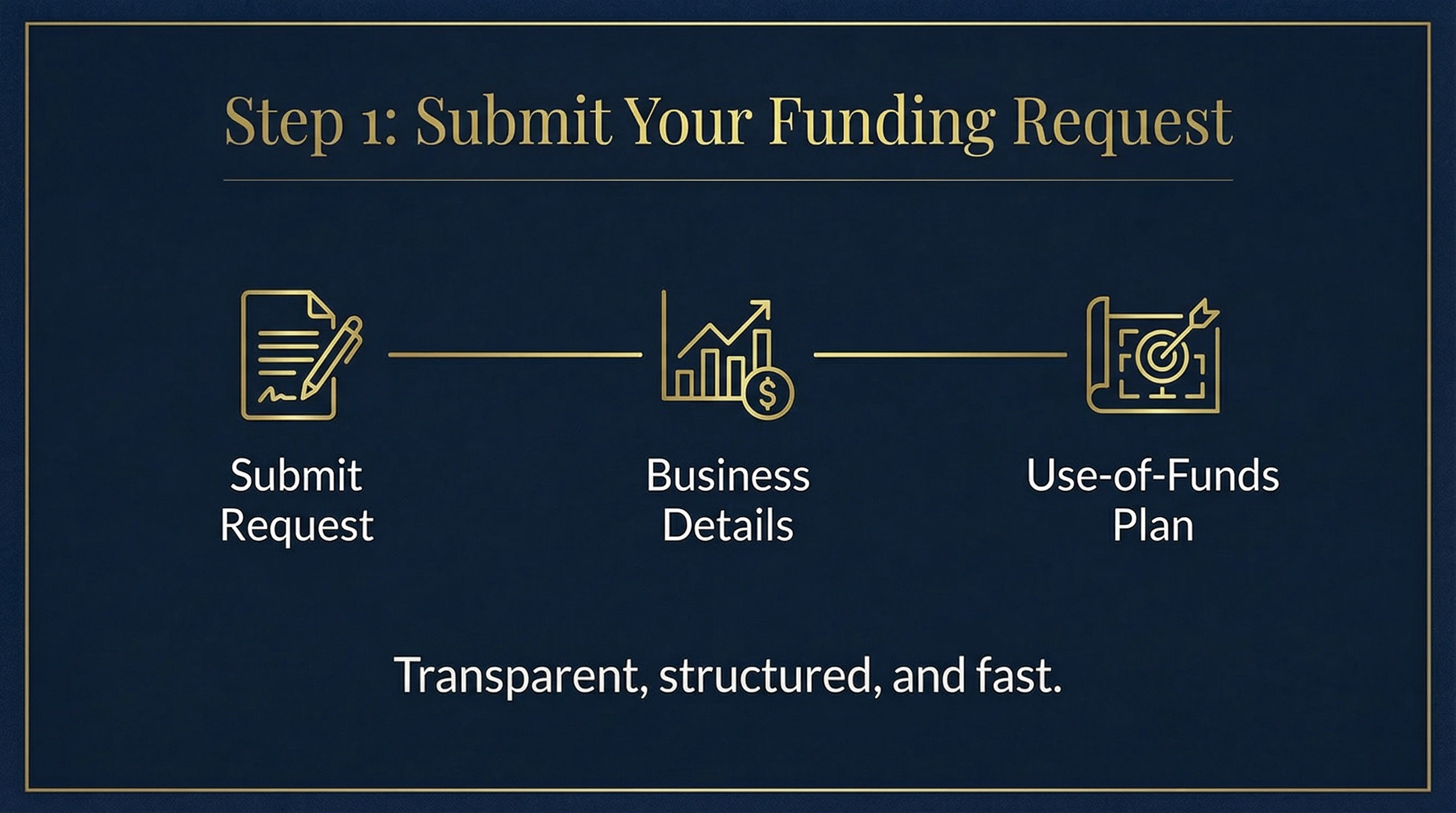

How Loans Work – Step 1

When a member needs capital, they submit a clear funding request with business details and a use-of-funds plan. This is not a mystery process—it’s transparent, structured, and fast.

8

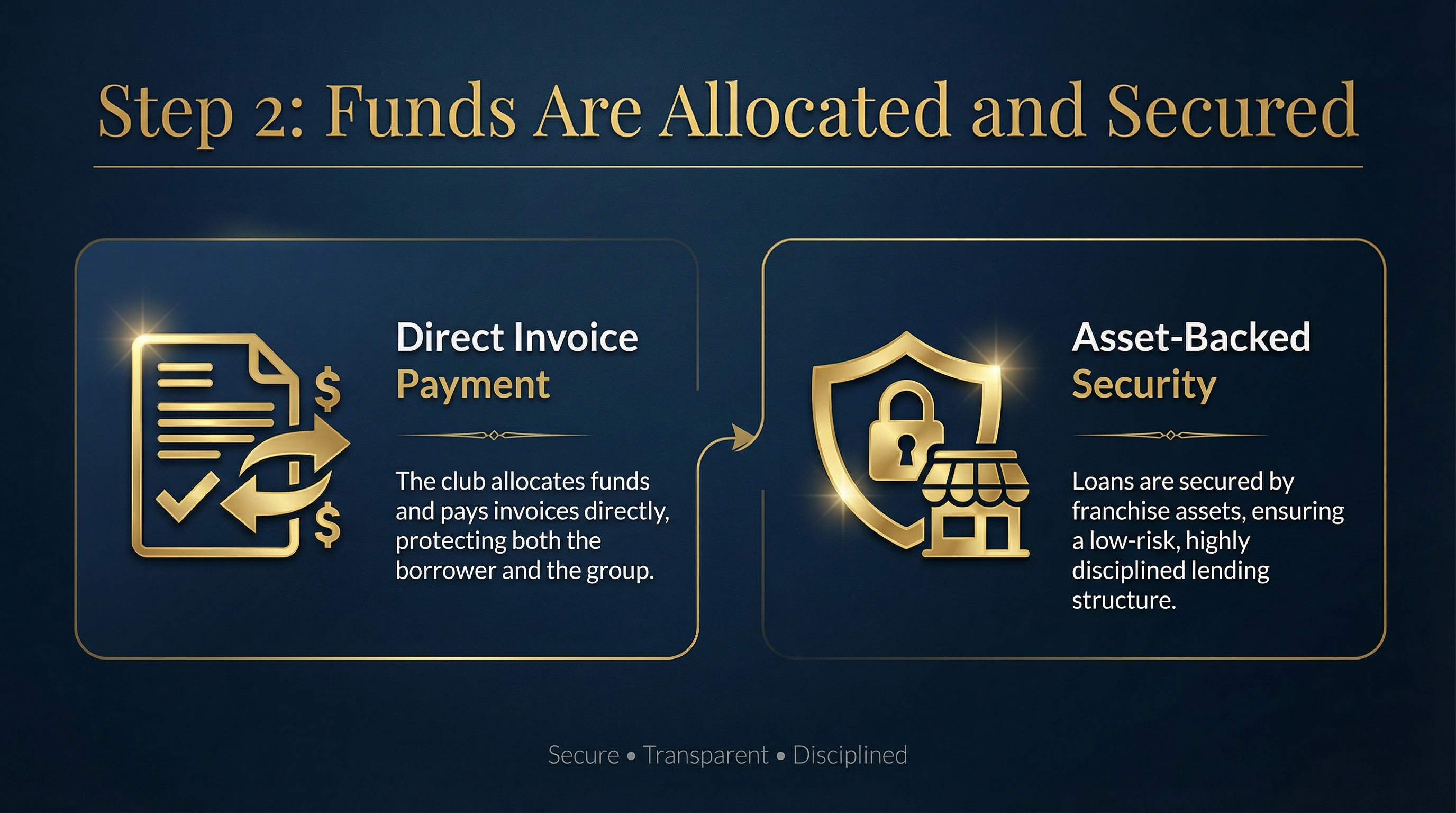

How Loans Work – Funding & Security

The club allocates funds and pays invoices directly, which protects both the borrower and the group. Loans are secured by franchise assets, ensuring a low-risk, highly disciplined lending structure.

9

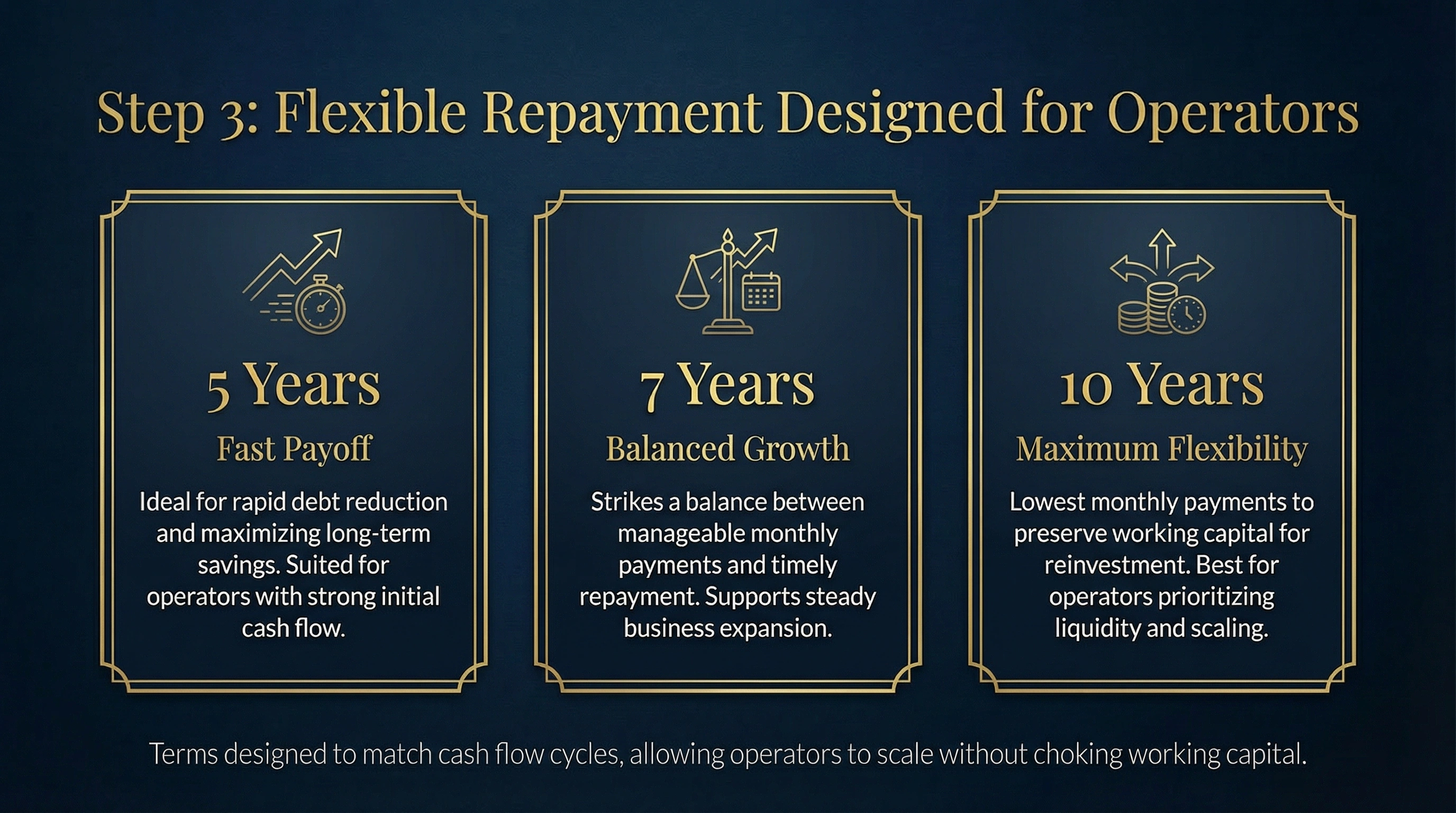

How Loans Work – Repayment

Repayment terms are flexible—five, seven, or ten-year amortizations—designed to match cash flow and growth cycles. This allows operators to scale without choking working capital.

10

Eligibility & Exclusivity

This is not for everyone—and that’s intentional. We are limiting founding membership to just 15 operators. Eligibility includes $10M+ in annual revenue, ownership of 10 or more franchise locations, and a five-year growth plan. Once the 15 spots are filled, founding access closes.

11

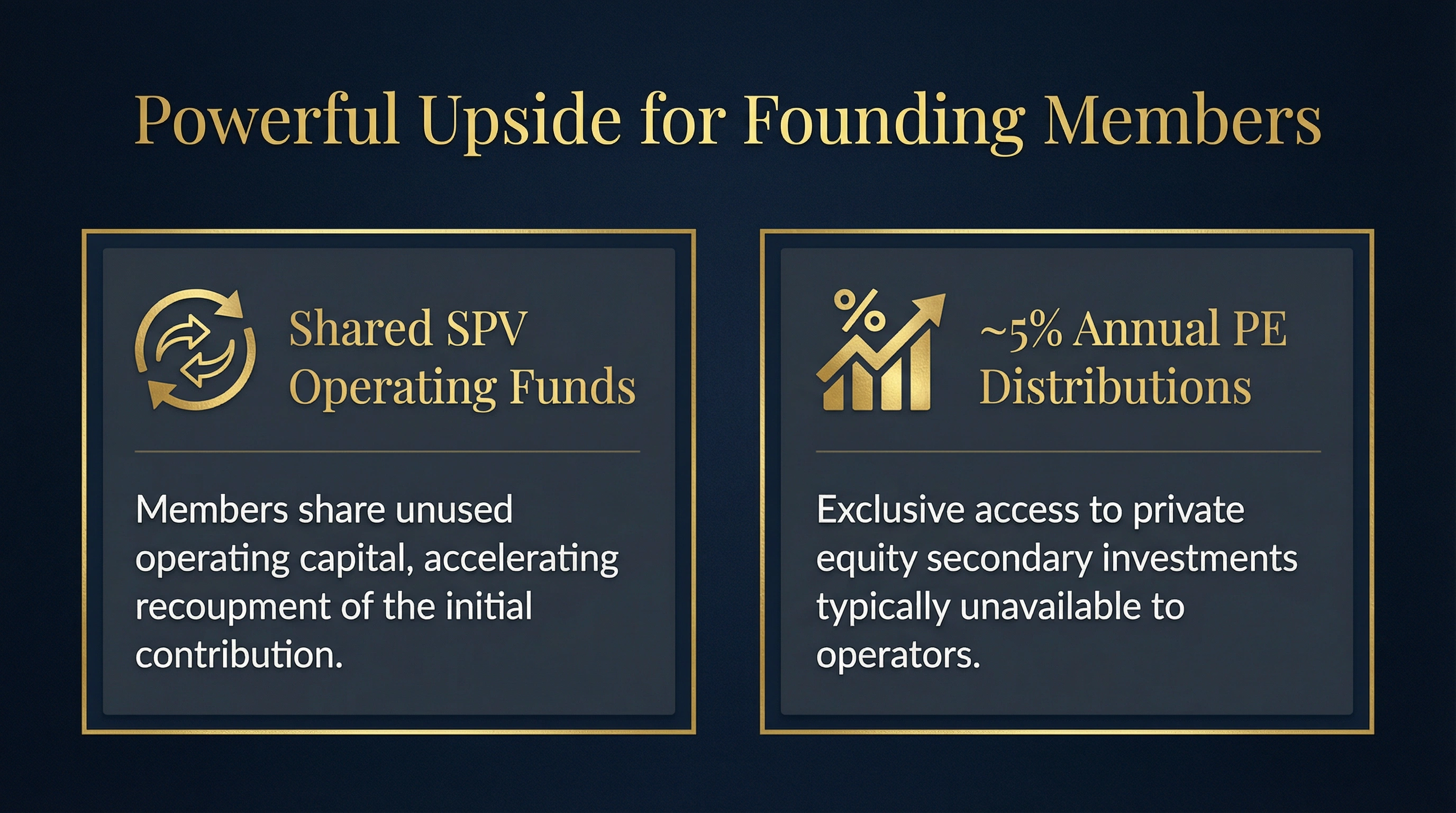

Founding Member Rewards

Founders receive powerful upside. Members share unused SPV operating funds, accelerating recoupment of the initial contribution. In addition, founders receive approximately five percent annual distributions from private equity secondary investments—exclusive access typically unavailable to operators.

12

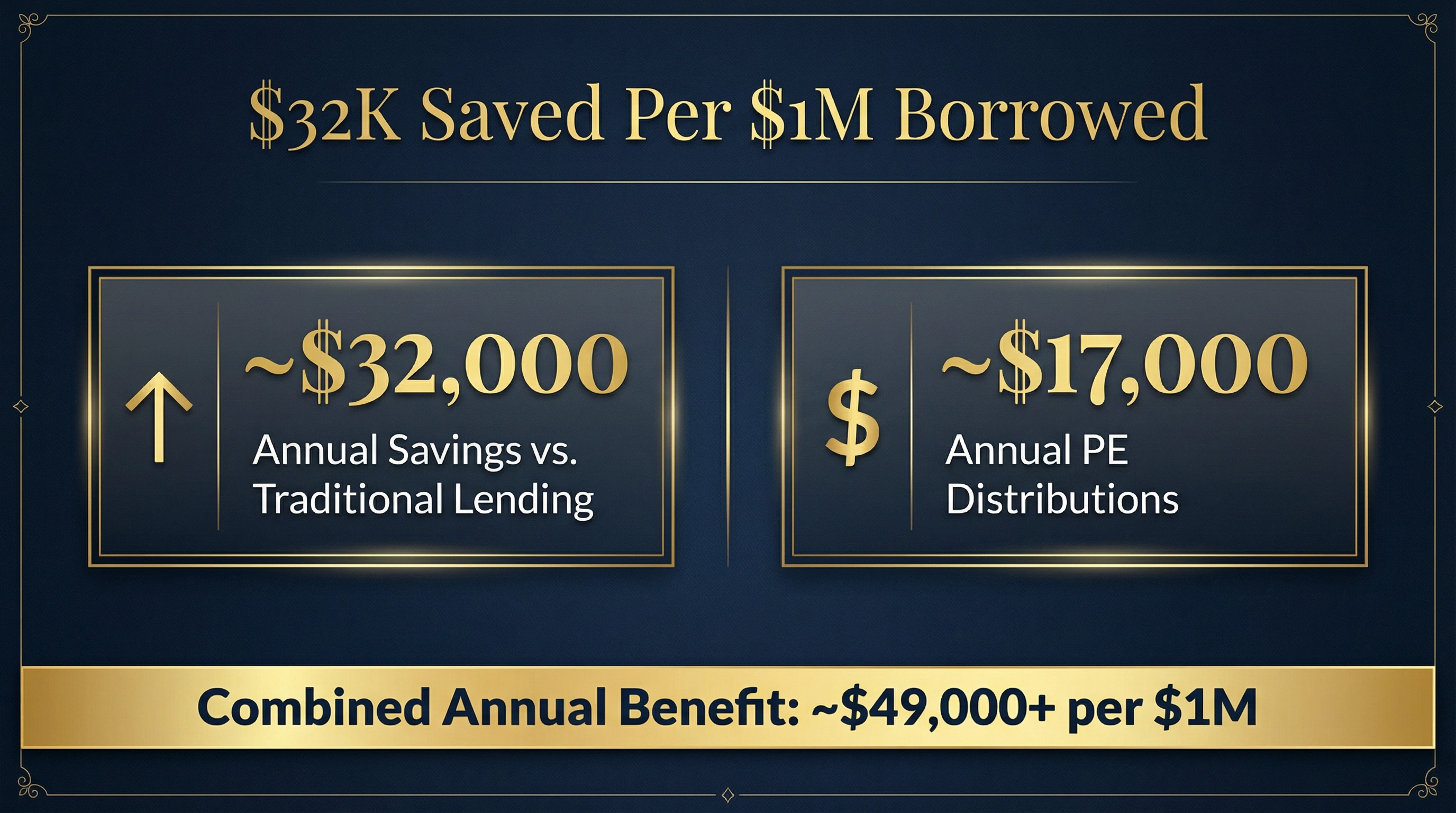

Why This Matters Financially

Let’s talk real numbers. Institutional rates around five percent can save roughly $32,000 per million dollars borrowed each year compared to traditional lenders. Add annual PE distributions—around $17,000—and most members recoup their fee through interest savings and rewards alone.

13

Why Join FFS?

FFS removes financial obstacles so growth is no longer limited by capital access. It delivers strong ROI with minimized risk through secured lending. Members grow faster, borrow cheaper, and participate in upside—supported by a private equity-backed structure.

14

Call to Action

If this aligns with your growth goals, the next step is simple. Schedule a conversation with Cher Gamell to be considered for founding membership. This is a limited opportunity, and once the 15 spots are filled, access closes. We’re not just funding growth—we’re building a powerful ownership community.

15

Thank you!

Thank you for your time. FFS exists to help serious operators scale with confidence, clarity, and control. We’d be honored to explore whether this is the right fit for you