Slides & Script

Build your webinar slide by slide with script narration

7

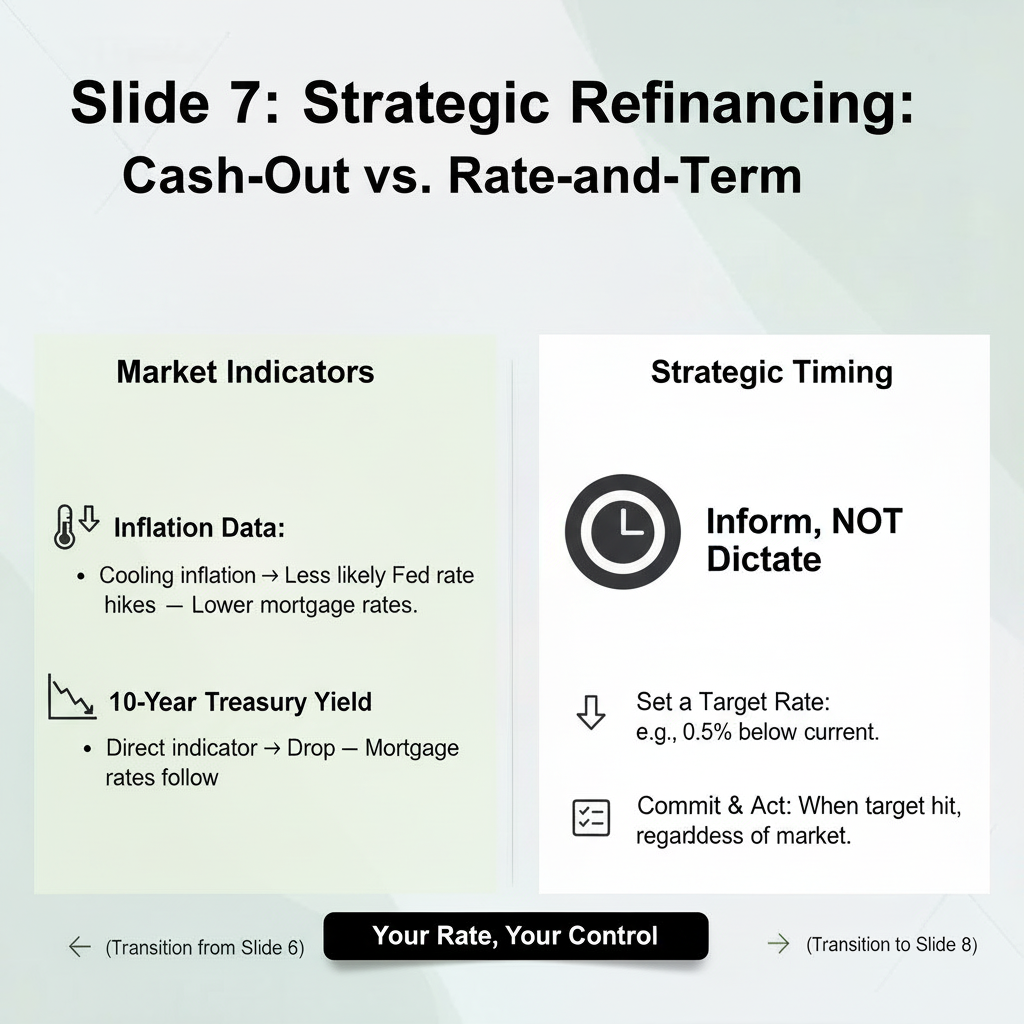

Slide 7: Strategic Refinancing: Cash-Out vs. Rate-and-Term

Keep a close eye on inflation data. If inflation is cooling, the Fed is less likely to raise rates, which generally pushes mortgage rates down. The 10-Year Treasury Yield is the most direct indicator. If it drops, mortgage rates usually follow. While these indicators give you a sense of direction, they should inform your timing, not dictate it. Set a target rate—say, 0. 5% lower than current—and commit to acting when that target is hit, regardless of whether the market might drop further.

8

Slide 8: Market Indicators to Watch

(Transition to Slide 9)

So, what should you do when you leave this webinar? First, gather your data. Second, shop around. Loan Estimates are standardized documents, making comparison easy. Don't just look at the rate; look at the total closing costs. Third, run the break-even calculation. Fourth, be honest about your future plans.

9

Slide 9: Actionable Next Steps

If you plan to move in two years, refinancing is almost certainly a bad idea unless you have zero closing costs. Use these steps to move from speculation to a data-driven decision. (Transition to Slide 10)

To summarize: Refinancing is a powerful tool, but it must be applied strategically. Don't let fear of missing out drive your decision. Let the math drive it. If the numbers work and your time horizon supports the break-even point, act now. If not, set a target rate and monitor the market.